The Law Society of Ireland has announced the introduction of new Solicitor’s Accounts Regulations, which will come into effect from 1st July 2023. Many of the changes are long overdue and aimed at modernising and simplifying current regulations that have been in place since 2014. Nonetheless, they’re expected to place a significant burden on solicitors.

The new regulations are designed to streamline the accounting process for solicitors, making it easier for them to comply with their legal and professional obligations. Most importantly, they’re aimed at protecting client monies and preventing fraud in an overall modernisation of the profession.

Much of what’s outlined in the new regulations is already standard practice in most law firms. However, from the current information published by the Law Society of Ireland, we have identified six main areas of impact.

1. Solicitors are “no longer [required] to open a separate bank account where a solicitor is acting as personal representative of an estate.” This should relieve the burden for firms that find themselves in the situation of being appointed as executors/administrators of estates.

2. “Balancing statements are to be prepared at quarterly intervals in respect of client account transactions.” Previously, this was only done every six months, and the doubling of this work will prove costly from a resource perspective. Firms will need to invest in more accounting resources to help alleviate the additional workload.

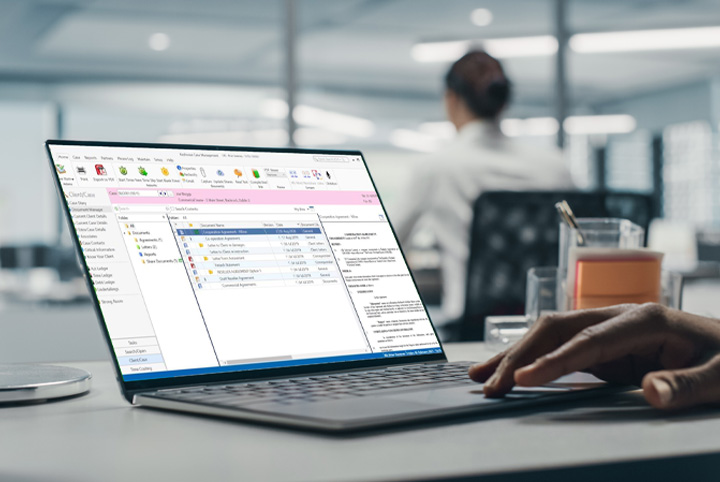

3. “Client ledger balances are to be reviewed for undue or unnecessary delays in discharging client moneys and immediate action taken to clear same, where appropriate.” The Law Society is yet to define what exactly is meant by “undue or unnecessary delays,” and the impact of this could be significant for solicitors and their bookkeepers. Firms will need legal accounting software with strong reporting capabilities such as Dye & Durham’s Keyhouse Legal Accounts to comply with this requirement.

4. “A file of documents or record in respect of electronic transfers to be maintained.” Even though this may sound like standard practice, it will place a burden on firms to keep electronic records held against relevant cases if they do not have adequate document management in place.

5. “Responsibility for breach of the regulations extends to the solicitor responsible for the actual breach, and not just the principal or partners of the firm.” This means responsibility shifts to the individual in addition to all the solicitors in the firm, not just the partners.

6. “A listing of Client Balances outstanding two years, or more is to be prepared at the accounting date and furnished to the Law Society by the Reporting Accountant.” This is a departure from the previous rules in that the reporting accountant will now be required to report on client balances. Previously, any queries about dormant balances were only addressed as part of a Law Society audit. While not all of the details of this new rule are known yet, this may also require firms to explain why they have outstanding client balances.

Under the new regulations, solicitors will be required to continue to maintain accurate and up-to-date accounting records. They will also be required to maintain a client account that must be kept separate from their own personal and business accounts. Any money received from clients must be deposited into this account, and all payments made to clients must be made from this account. This is standard, but the introduction of the maintenance of positive balances could be problematic for law firms across the country.

The new regulations will also require solicitors to carry out regular reconciliations of their client accounts to ensure all funds are accounted for and that there is no misappropriation of funds. This will involve reconciling client account balances with underlying transactions and ensuring that any discrepancies are investigated and resolved promptly.

While the new regulations are aimed at simplifying and modernising the accounting process for solicitors, they are expected to place additional burdens on the profession. Solicitors will need to invest in specific legal accounting software with robust reporting functionality in line with Law Society reporting requirements.

The Law Society has recognised that the new regulations may be difficult for the profession and has called on the government to provide support to solicitors so they can comply with the new regulations. This could include funding for training and software, as well as additional resources to help solicitors manage the increased workload. More information about this has yet to be released, though it’s expected to be published in the coming months.

Go to Media