As the mandatory PII renewal date of December 1, 2023, approaches, solicitors are undoubtedly working to obtain or renew their professional indemnity insurance (“PII”). Aside from it being required by regulatory bodies, having PII cover is essential as it protects against civil liability claims and enhances a firm’s financial security.

To help solicitors navigate the process successfully, we’ve put together the top three priorities for consideration:

- Start Early

Starting the PII renewal process early is crucial. Besides the obvious benefit of allowing yourself time to go through the process and get the best results, insurers often have a limit on the amount of business they are willing to accept. Once insurers reach their coverage limit, they will no longer provide insurance, potentially causing you to miss out on your preferred provider. Additionally, submitting common proposal forms well in advance of the deadline is seen as a sign of professionalism and good management. It also indicates that the firm is less likely to be a significant risk. - Do Research

Before entering into any agreements, conducting research on the current PII market conditions would be beneficial. Specific areas to research include:- Insurers: Your chance of finding affordable cover increases with the number of quotes you receive from insurers. Therefore, consider sending your common proposal form to all insurers that provide coverage for your type of practice. Doing this can help you find the best insurance policy that suits your needs and budget. Also, determine the key issues insurers will look for when evaluating proposals and ensure your proposal form covers such issues.

- Brokers: Brokers are providing you with a service and being paid a fee, so ensure you maximise the relationship. Your broker should act in the best interests of your firm and provide quality service and fair treatment. Also, keep in mind that brokers may only have access to a limited number of insurers in the market. To get access to all insurers that provide coverage for your type of practice, consider using more than one broker.

- Financing: PII premiums have risen over the last few years due to challenging markets resulting from global issues. Solicitors can take advantage of available financing options to finance their premiums, including loan facilities. Some insurers offer the option to spread premium payments over the year, using monthly or quarterly payments.

- Be Meticulous

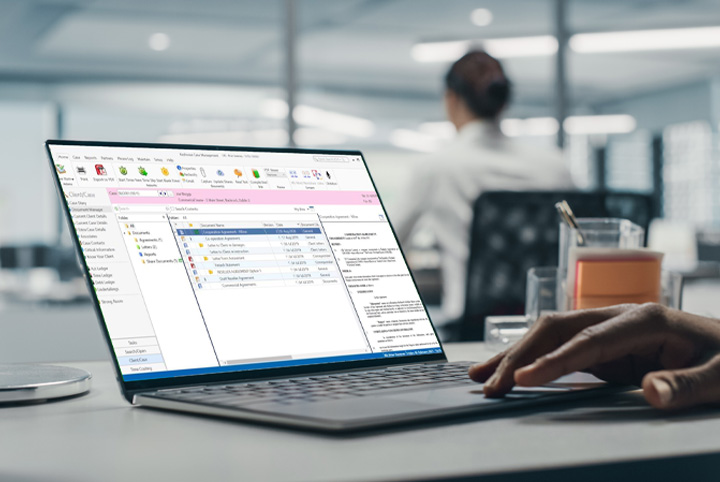

Renewing PII can be a tasking process, but it is worth investing time and attention to it. Start collecting the necessary information well in advance. Make sure to fill out your common proposal form accurately, legibly, and completely, and double-check that all the figures match up when providing a fee breakdown. A comprehensive practice management solution like Keyhouse Practice Management software from Dye & Durham is really beneficial since it provides all the necessary PII report figures in a single report.

For detailed information on the PII Renewal for 2023/2024, including the common proposal form and other relevant documents, visit this Law Society resource page.

To learn more about our suite of comprehensive practice management solutions and book a free demo, call us now on 01 290 2222.

Go to Media